2 hours ago

Latest Updates

Featured Posts

Get in Touch

Location:

123 Innovation Street

Tech District, CA 94105

123 Innovation Street

Tech District, CA 94105

Email:

[email protected]

[email protected]

Phone:

+1 (234) 567-890

+1 (234) 567-890

News

Sandra Oh on Happiness, Gloom – and Becoming an Internet Sensation with an Euphoric Dance

Edward Taylor

Sep 16, 2025

Edward Taylor

Sep 16, 2025

News

Cramp Cocktails and Applications: The Way Rugby Tracks the Critical Health Metric

Edward Taylor

Sep 16, 2025

News

The Film Review: Local Remake of the Acclaimed Drama on Toxic Masculinity

Edward Taylor

Sep 16, 2025

News

Government Pension Likely to Increase by 4.7% Beginning in April

Edward Taylor

Sep 16

News

Samia Halaby: Following Exhibition Cancellations to Artistic Vindication

Edward Taylor

Sep 16

Today's Top Highlights

Stay updated with the latest insights and trends in online gaming

News

READ MORE

READ MORE

US Secretary of State Inaugurates Israeli Settler-Led Archaeological Project in the Holy City

Edward Taylor

16 Sep 2025

News

READ MORE

READ MORE

Unai Simón: ‘Conseguir un título con el Athletic me completa más que una decena de campeonatos en cualquier otro lugar’

Edward Taylor

16 Sep 2025

News

READ MORE

READ MORE

I Previously Enjoyed Wonderful Vaginal Orgasms: What Caused Them to Cease – and How Can I Get Them Back?

Edward Taylor

16 Sep 2025

News

READ MORE

READ MORE

No ‘Unorthodox Rugby’ from Fresh England National Coach Lee Blackett

Edward Taylor

16 Sep 2025

News

READ MORE

READ MORE

Zelenskyy Urges Donald Trump to Establish a Definitive Stand on Russia

Edward Taylor

16 Sep 2025

News

READ MORE

READ MORE

Craig McLachlan Withdraws from Stage Play Cluedo Amid Casting Controversy

Edward Taylor

16 Sep 2025

News

READ MORE

READ MORE

Auf welche Weise künstliche Intelligenz unsere Spezies neu konfigurieren wird: Eine Lehre aus einem deutschen Märchen

Edward Taylor

16 Sep 2025

News

READ MORE

READ MORE

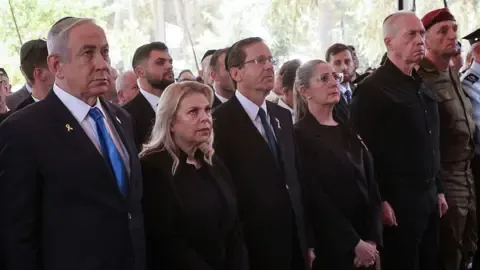

UN Commission Concludes Israel Carried Out Genocide in the Gaza Strip

Edward Taylor

16 Sep 2025

Recent Posts

News

News

News

News

News

News

September 2025 Blog Roll

August 2025 Blog Roll

July 2025 Blog Roll

June 2025 Blog Roll

Sponsored News

News

The Premier League club Dismisses Staff Member for Wearing Opposing Club Shirt on Match Day

Edward Taylor

Edward Taylor

16 Sep 2025

News

JLR Automotive Group Continues Production Shutdown In the Wake of Cyber-Attack

Edward Taylor

Edward Taylor

16 Sep 2025

News

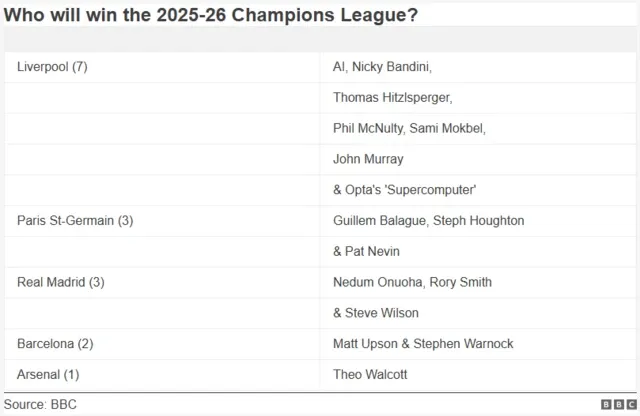

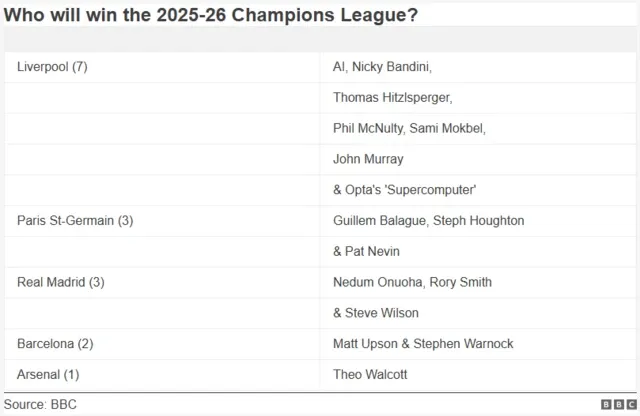

Champions League Returns & Pundit Insights Coming Up

Edward Taylor

Edward Taylor

16 Sep 2025

News

Share Ways Entertainment Media Prompted A Dramatic Transformation

Edward Taylor

Edward Taylor

16 Sep 2025

News

UN Investigation Delivers Strong Indictment of Israel's Conduct in Gaza

Edward Taylor

Edward Taylor

16 Sep 2025

News

Young people Convert Their Bedrooms Into Tech-Free Areas: Revealing Findings

Edward Taylor

Edward Taylor

16 Sep 2025